Bristol property prices

The Bristol property market has entered the new year with renewed momentum, reflecting both national trends and a noticeable uplift in activity across all our offices.

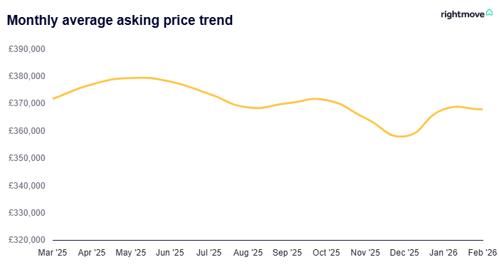

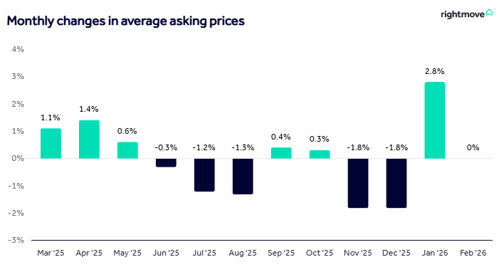

House prices paused in February, but the year is still off to a strong start. The average asking price of newly listed homes barely moved in February, slipping by just £12 to £368,019, essentially unchanged.

Even so, the property market is still showing one of its strongest starts to the year since 2020. Thanks to a record jump in January’s asking prices for that time of year, average prices are now 2.8% higher than they were in December. (Rightmove)

Most of that early-year momentum came in January, as confidence returned following months of uncertainty around the Autumn Budget. But with plenty of homes on the market and buyer activity remaining steady rather than surging, prices didn’t see another push upward in February.

Why 2026 is looking like a promising year for homebuyers

If you’re thinking about getting onto the property ladder – or moving up it, 2026 is shaping up to be a much friendlier year for buyers. Better affordability, more choice, and improving mortgage deals are all helping to create a more balanced market.

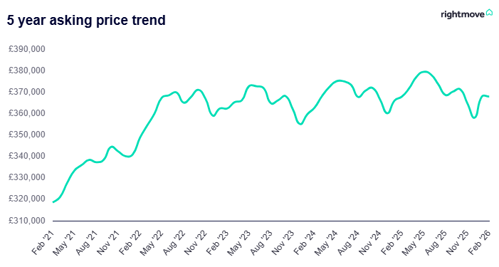

For starters, average property prices are roughly the same as they were this time last year. That’s particularly good news for first-time buyers who’ve been working hard to save their deposits, as their target hasn’t suddenly jumped out of reach.

On top of that, wages have risen by 4.7% year-on-year. This increase is actually higher than the total property price growth seen over the past three years combined, meaning buyers’ earnings are finally starting to catch up after a long stretch of rising costs.

There’s also a lot more choice out there. The number of homes for sale is the highest it’s been at this point in the year for more than a decade, giving buyers more room to shop around, compare options, and negotiate.

Mortgage lenders are continuing to introduce products that allow eligible buyers to borrow a little more, making it easier for some people to afford the type of home they want. At the same time, average mortgage rates remain close to their lowest level since the turbulence following the September 2022 mini‑Budget.

Rightmove’s daily tracker now shows the average two‑year fixed rate at 4.28% — a big drop from 4.96% just a year ago, and a welcome boost to monthly affordability.

All of this adds up to a market that feels more balanced and more accessible, giving buyers a better hand to play as they look ahead into 2026.

Bristol, North Somerset and South Gloucestershire prices

There’s a twelve-year high number of homes for sale for this time of year, so buyers have lots of choice, and a third of properties that were already on the market for sale have had a price reduction. This means that sellers need to be realistic and balance the price they want to achieve with the likelihood of being able to find a buyer in their local market at that price. (Rightmove)

Get in touch with your local Ocean office for real‑time updates on what’s happening in your property market.

National

The latest available data shows that UK house prices continued to see steady but modest growth going into early 2026. According to the ONS UK House Price Index, the average UK property price reached approximately £271,000 in November 2025, an annual increase of 2.5%, up from 1.9% annual growth in October.

This reflects a small 0.3% monthly rise and indicates gently rising price momentum toward the end of 2025 (ONS, Land Registry). Meanwhile, portal data shows that early 2026 brought an unusually strong rebound after a subdued finish to 2025.

Looking ahead, market forecasts suggest renewed momentum. Independent forecasts compiled by HM Treasury indicate that UK house prices are expected to grow modestly in 2026, with many analysts projecting increases of around 2%-3%, supported by easing mortgage rates, improving buyer affordability and stabilising economic conditions.

“It’s important to remember that among records and national trends, Great Britain’s housing market is made up of thousands of diverse local markets, each uniquely responding to market changes" Colleen Babcock, property expert at Rightmove

Home Valuation

Curious to know your home's sale or rental value?

We're here to help...