Bristol, South Gloucestershire and North Somerset Lettings Market and Rental Yields

Latest lettings update

There are currently 4,424 properties available to rent in Bristol which is 60.1% higher than a year ago. 64.2% of homes listed to rent in the past 12 months were flats.

Properties rented in the last month had been on the market for an average of 18 days which is 17.1% longer than a year ago.

However, Bristol’s lettings market remains strong, with rents and landlord yields continuing to outperform much of the wider South West. Demand remains consistently robust across the city.

Average Monthly Rent

Over the last 12 months, the average rent achieved for homes let in Bristol was £1,507 per month. This is a +2.6% change on the previous 12 month period. Flats achieved an average rental of £1,396 per month. Houses achieved an average rent of £1,755 per month.

Bristol rental market

Rental appraisalBristol Yields

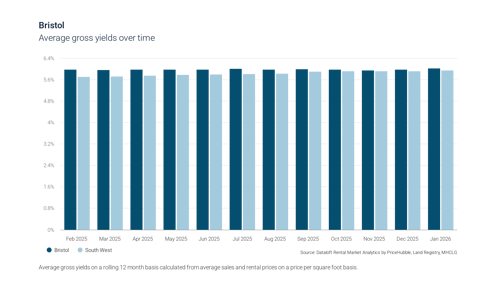

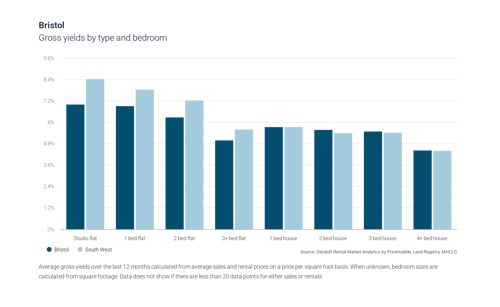

Bristol’s average gross rental yield is around 6.0% in early 2026, outperforming many major UK cities where yields typically sit below 5%.

Yields vary widely across the city, with districts such as BS16 and BS34 achieving up to 8-8.5%, (student accommodation) while more premium areas often fall closer to 4-5%.

High‑demand neighbourhoods like Easton and Fishponds continue to deliver strong returns, frequently reaching 7-8% gross yields.

Overall, Bristol remains a robust lettings market, with yields consistently outperforming much of the wider South West region.

National view point

National data indicates that time to let averaged 17 days going into 2026 as the market rebalanced and supply increased. Bristol continues to mirror this trend: well‑priced properties typically let within 2-4 weeks, though overpriced listings can remain longer.

The market is shifting gradually toward balance

Supply has improved, but not enough to put downward pressure on rents. Demand remains strong, supported by Bristol’s universities, inward migration, and constrained housing supply. Rent growth is expected to moderate to 3-4% during 2026 as more stock comes online.