November Market Report. Local property news for you...

Market activity remains strong when compared with last year.

Since the Budget we have also had a second Bank Rate cut, with Rightmove’s real-time data identifying early signs of a subsequent boost in buyer activity. Sustained strong market metrics compared with last year and optimism for lower mortgage rates in 2025 have led to Rightmove forecasting a 4% increase in average new seller asking prices next year. Despite this prediction, the market is expected to remain price-sensitive, and sellers are currently competing with a decade-high number of other sellers to attract a buyer. While more mortgage rate cuts are still expected during 2025, Bank Rate cuts are now forecast to be slower-paced, which could delay the affordability improvements that some movers have been holding out for.

“There’s been a lot of news to digest for home-movers over the last few weeks and it appears that the market may still be chewing it over. We had been seeing a drop-off in buyer demand, both in the lead-up to the Budget and in its immediate aftermath, as it was confirmed that there will be an increase to stamp-duty charges for most home-movers and second-home buyers, and some first-time buyers. However, a second Bank Rate cut and a boost of optimism regarding 2025 appear to have reversed this trend at least temporarily. Zooming out of these short-term trends, the big picture of market activity remains positive when compared to the quieter market at this time last year. This sets us up for what we predict will be a stronger 2025 in both prices and number of homes sold, particularly if mortgage rates fall by enough to significantly improve affordability for more of the mass-market.” Tim Bannister Rightmove’s Director of Property Science

Economy

The Bank of England has reduced interest rates to 4.75%, down from 5%. This marks the second cut since 2020. Monthly GDP is estimated to have grown by 0.2% in August, after showing no growth in July (ONS).

CPI inflation rose by 1.7% in the 12 months to September, down from 2.2% in August (ONS).

Prices

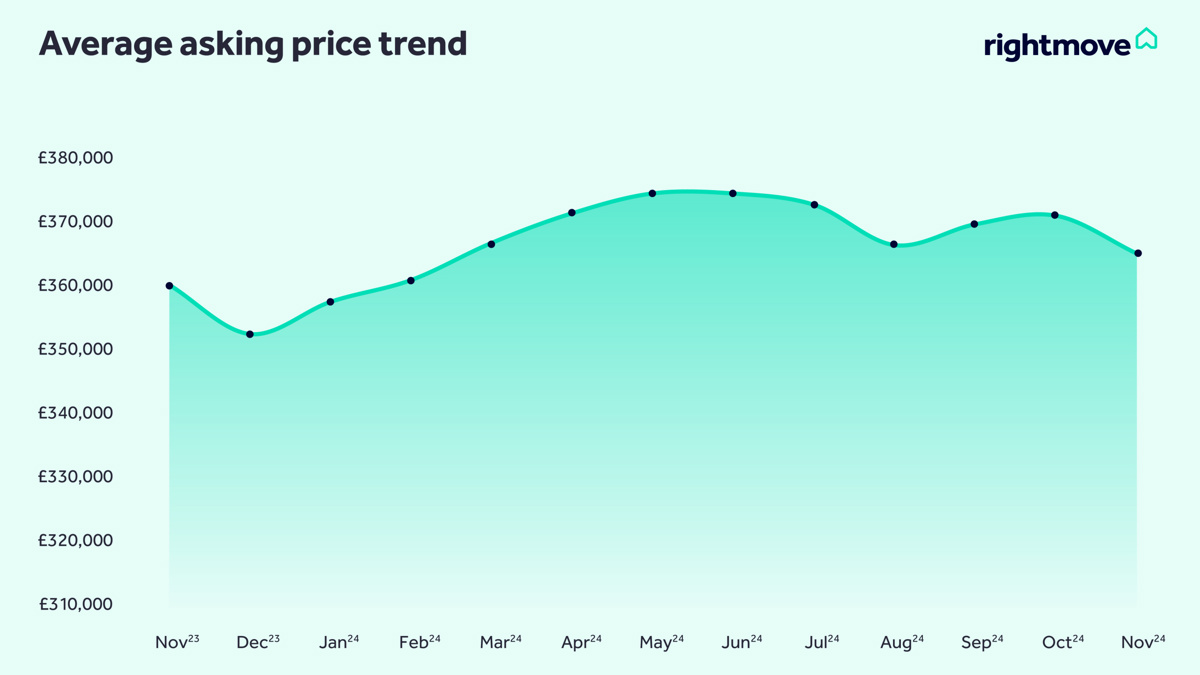

Average new seller asking prices drop by 1.4% (-£5,366) this month to £366,592 nationally, a bigger fall than the usual, seasonal 0.8% drop seen at this time of year, likely due to pre- and post-Budget jitters.

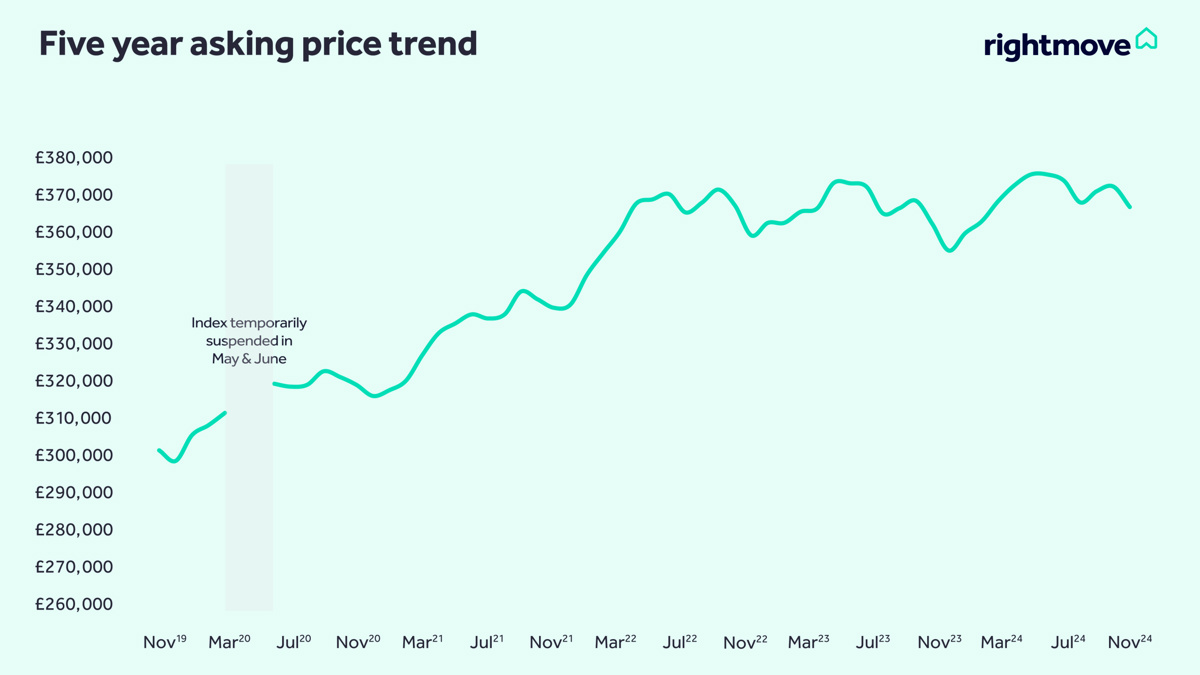

However; a combination of sustained positive market activity and the expectation that mortgage rates will lower over the course of next year has led to Rightmove’s 2025 forecast of a 4% increase in average new seller asking prices.

This is Rightmove’s highest prediction for increases in prices since 2021, with improving buyer affordability and the release of some pent-up demand expected to put modest upwards pressure on prices next year. However, there is still caution for sellers as we approach 2025, with the market expected to remain price-sensitive.

Bristol

The highest value recorded by the Land Registry over the past 12 months was £1,205,000 for a flat and £3,799,994 for a house.

Demand

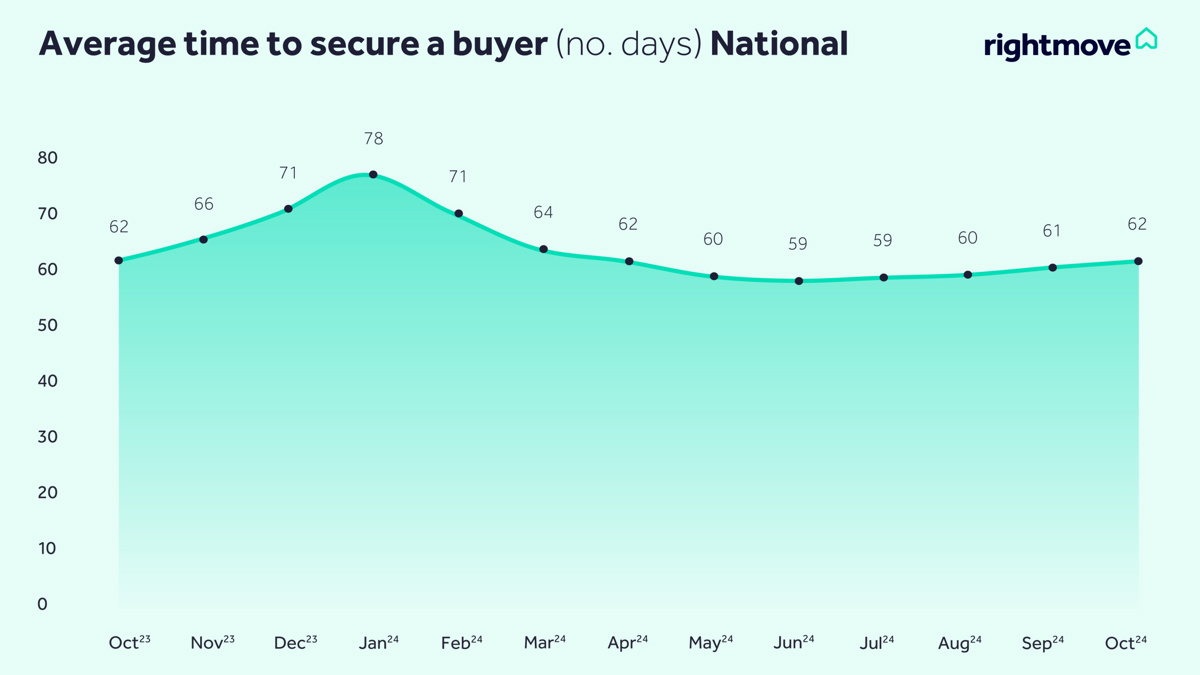

There were 65,647 mortgage approvals in September which is 49% higher than a year ago (Bank of England). The reading of new buyer enquiries in the October RICS survey was +12%, marking the fourth successive report in which the indicator has returned a positive reading.

Home buyer demand is up 26% on this time last year (Zoopla).

Transactions

There were 91,820 transactions in September, a 8.9% rise compared to a year earlier (HMRC).

The agreed sales metric in the latest RICS survey posted a net balance reading of +9%, up from +5% last month.

The number of sales being agreed is up by 26% compared to last year's quieter market (Rightmove).

Investment/lettings

The average UK rent fell by -0.3% in October to £1,327, 3.4% higher than the same time last year (HomeLet).

The average amount of income that UK renters spent on their rent in September was 32.6%, unchanged from August (HomeLet). Average void periods lengthened from 15 days in September to 19 days in October - an increase of 27% (Goodlord).

We hope that was useful and informative. As always, our teams are here to help, get in touch with any questions about your local property market, and to discuss your home move considerations.

If securing a new mortgage or arranging a re-mortgage is important for you right now, click here to book an online consultation, our mortgage brokers are independent, and their services are free to you.

Finally, if you are (understandably) confused by some of the mixed market reporting, not least by some of the more sensational news reporting each month, click here for some independent insight into how House Price Indexes are compiled.

Sources: Rightmove, Zoopla, On the Market, Dataloft, Land Registry, National House Price Index, DLUHC

Contact your nearest office if you have any questions about your local property market.

Share

Tags