Our sales teams wondered if the enquiries, new instructions and offers would pause for the recently announced General Election. History tells us national elections can have a quieting effect on the property market. But no, we can confirm Bristol sellers have been very proactive again this month, with a great choice of properties of all types coming to market. And many buyers have proven there's no time to wait when it comes to securing their next home in Bristol.

Tim Bannister Rightmove’s Director of Property Science says - "Now that a General Election has been called, Rightmove’s whole-of-market data suggests that activity is largely remaining stable, with the market maintaining its 2024 momentum. The number of sales being agreed and the number of buyers sending enquiries to agents remain steady, with the vast majority of those already in the home-moving market continuing with their plans".

Economy

Rishi Sunak has announced a 4th July general election in a statement outside Downing Street.

Monthly GDP is estimated to have shown no growth in April 2024, following growth of 0.4% in March 2024 (ONS). CPI inflation rose by 2.3% in the 12 months to April 2024, down from 3.2% in March (ONS).

Prices

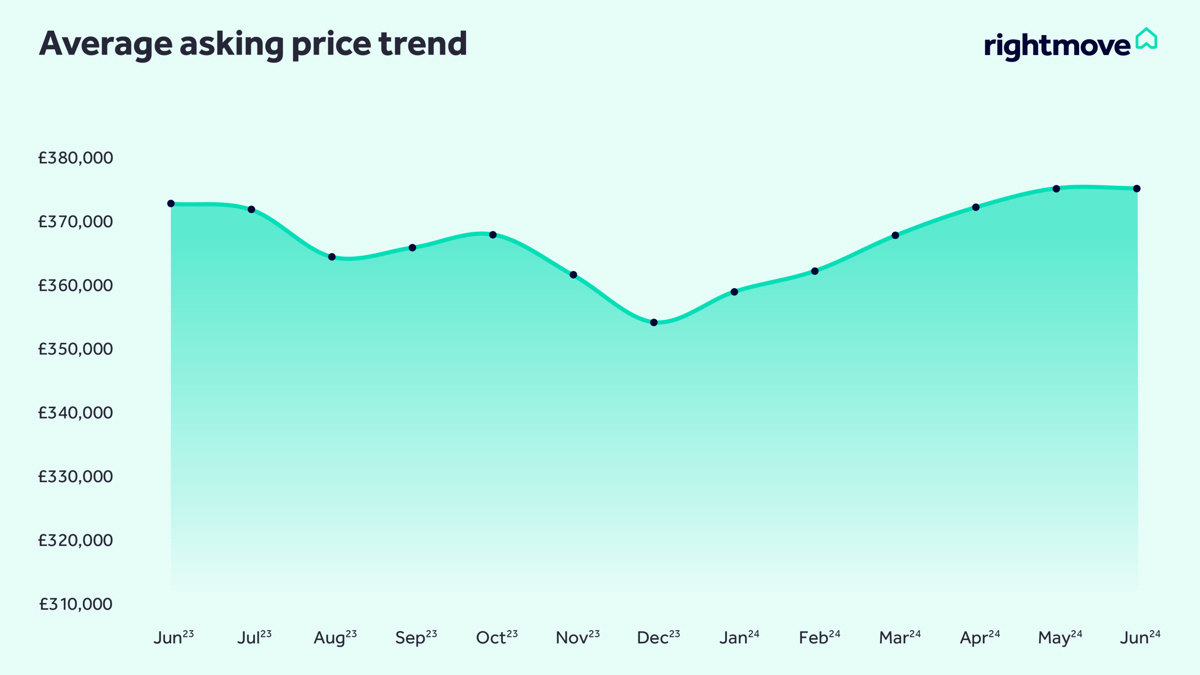

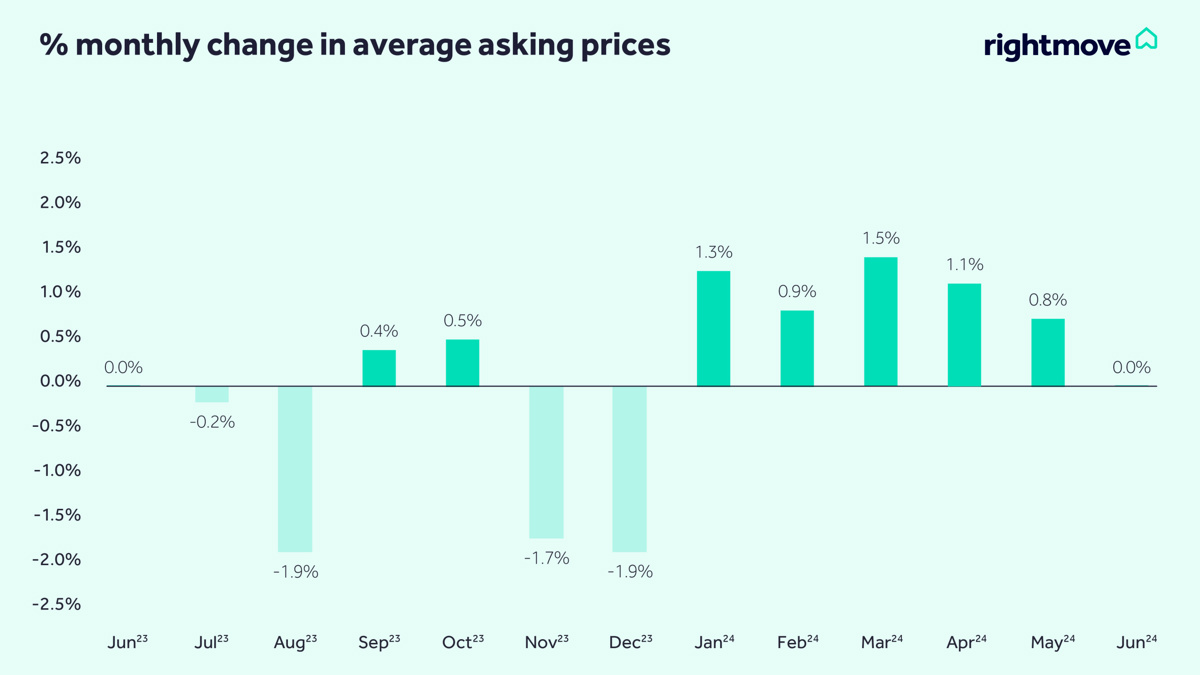

The average price of property coming to the market for sale drops by just £21 this month (0.0%) to £375,110 after reaching a record high in May, as prices in June follow their familiar seasonal pattern of recent years and remain flat.

The average price for a property in March was £282,776, up 1.8% year-on-year and 0.7% on the previous month (ONS). UK house prices rose 0.4% month on month in May, while the annual growth rate picked up to 1.3%, from 0.6% in April (Nationwide).

The average asking price of property coming to the market rose by 0.8% in May to a new high of £375,131, with the strongest growth in the top-of-the-ladder segment (Rightmove).

Bristol

Over the last 12 months the average sales price in Bristol was £358,471. The total value of sales was £1,437,370,221.

33% of sales in the past 12 months were flats, achieving an average sales price of £275,133. Houses achieved an average price of £408,310.

The highest value recorded by the Land Registry over the past 12 months was £2,950,000 for a flat and £3,799,994 for a house.

Demand

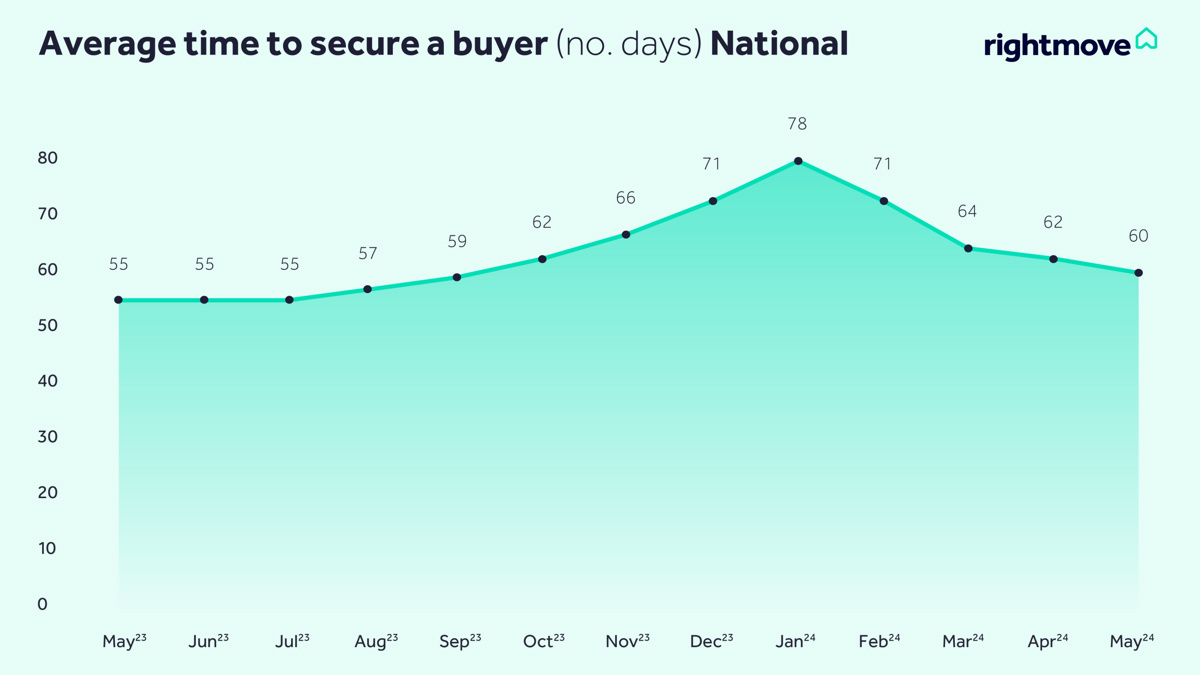

Over the last four weeks, the number of sales being agreed has stayed steady at 6% higher than a year ago Buyer demand has also remained stable and is now 5% higher than last year. This supports Rightmove’s poll of over 14,000 people, where 95% of those planning to move home said that the election will not affect their plans. In the two weeks since the surprise election announcement, the number of top-end sellers coming to market is 3% lower than a year ago, versus being 11% higher in the previous two-week period.

The number of new sellers coming to the market is up by 12% compared to this time a year ago (Rightmove).

There were 61,140 mortgage approvals in April, down -0.2% on the previous month but up 25.8% year-on-year (Bank of England).

Stubbornly high mortgage rates continue to stretch affordability, with many future movers likely to have a closer eye on when the first Bank of England rate cut might be, rather than pre-election housing market promises. The average 5-year fixed mortgage rate is now 5.04%, compared with 4.94% in January

Transactions

The HMRC reported that 90,430 sales took place in April, the highest level since March 2023 and up 9.8% on last year's levels.

The number of sales being agreed in the first four months of the year is 17% higher than last year (Rightmove).

Investment/lettings

Average UK private rents increased by 8.9% in the 12 months to April, down from 9.2% in March (ONS, Price Index of Private Rents).

The average UK rent rose by 0.2% in May to £1,297, 6.9% higher than the same time last year (HomeLet). The average void period in May was 11% higher than the same time last year, suggesting a slight lessening of the imbalance between demand and supply (Goodlord).

We hope that was useful and informative. As always, our teams are here to help, get in touch with any questions about your local property market, and to discuss your home move considerations.

If securing a new mortgage or arranging a re-mortgage is important for you right now, click here to book an online consultation, our mortgage brokers are independent, and their services are free to you.

Finally, if you are (understandably) confused by some of the mixed market reporting, not least by some of the more sensational news reporting each month, click here for some independent insight into how House Price Indexes are compiled.

Sources: Rightmove, Zoopla, On the Market, Dataloft, Land Registry, National House Price Index, DLUHC

Contact your nearest office if you have any questions about your local property market.

Share

Tags