July Market Report. Local property news for you...

Three major uncertainties hanging over the property market at the start of the year were when the first interest rate cut would be, and the timing and the result of the General Election.

Rightmove's Tim Bannister, Director of Property Science clarifies - We’ve now got the political certainty of a new government with a large majority, which we expect will help home-mover confidence. It’s very early days, but the new Chancellor’s immediate announcements on house building targets and planning reform are positive signs that the government is keen to get going with its manifesto pledges. With many areas of the market that could be improved, we hope the new government can get on with its plans and deliver sustainable housing policies that help the market in the medium to longer term. One area of the market in need of more support is first-time buyers, many of whom have been stretched to the limit by high mortgage rates, with some also facing higher stamp duty fees when the current thresholds are set to revert in March 2025.”

Economy

The bank rate has been left unchanged in June at 5.25%, with the next decision in August.

CPI inflation rose by 2.0% in the 12 months to May 2024, down from 2.3% in April (ONS).

Prices

The average price for a property in April was £281,373, up 1.1% year-on-year and 0.3% on the previous month (ONS). June saw a 0.2% rise in UK house prices taking the annual rate of growth rate to 1.5%, up from 1.3% in May (Nationwide).

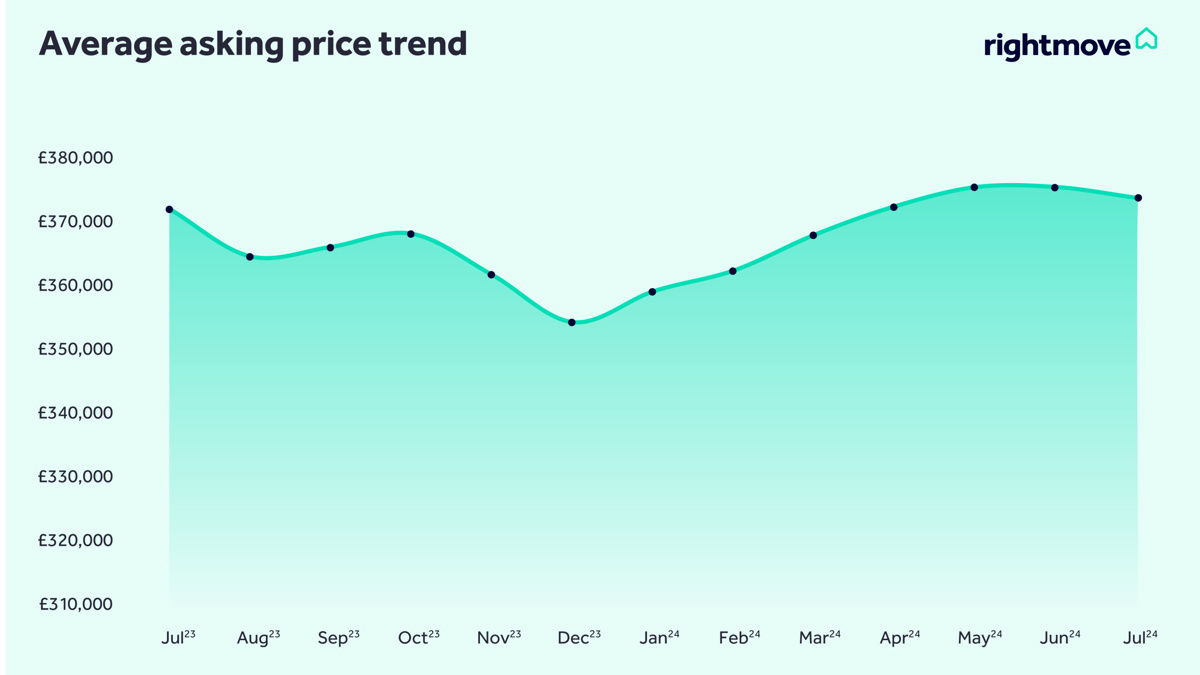

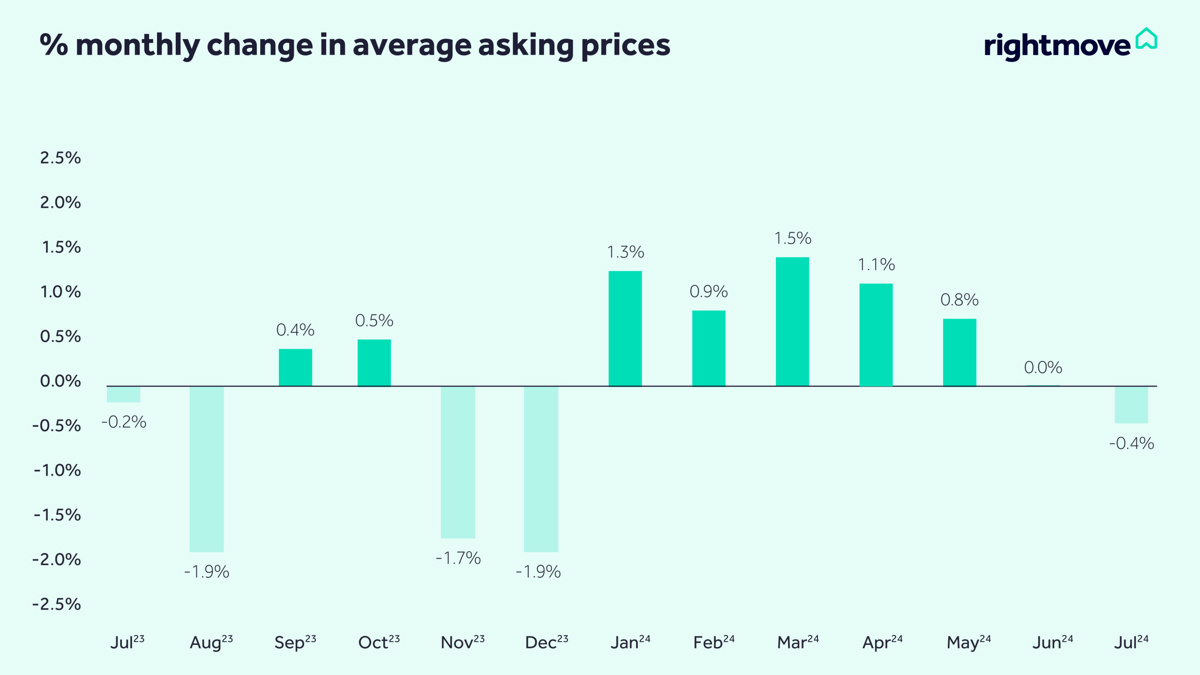

Average new seller asking prices drop by 0.4% (-£1,617) this month to £373,493, a bigger July drop than usual, as new sellers try to cut through the distractions of the General Election, sporting events and summer holiday season with a tempting price. (Rightmove)

Bristol

Over the last 12 months, the average sales price in Bristol was £358,997. The total value of sales was £1,304,289,893. 33% of sales in the past 12 months were flats, achieving an average sales price of £275,555. Houses achieved an average price of £408,684.

The highest value recorded by the Land Registry over the past 12 months was £960,000 for a flat and £3,799,994 for a house.

Demand

There were 59,991 mortgage approvals in May which is 19% higher than a year ago. In the first 5 months of this year, there have been 28% more approvals than a year ago (Bank of England).

The reading of new buyer enquiries in the latest RICS Residential Market Survey is -8%, down from a figure of -1% previously. Buyer demand is up by 5% compared to this time a year ago (Rightmove).

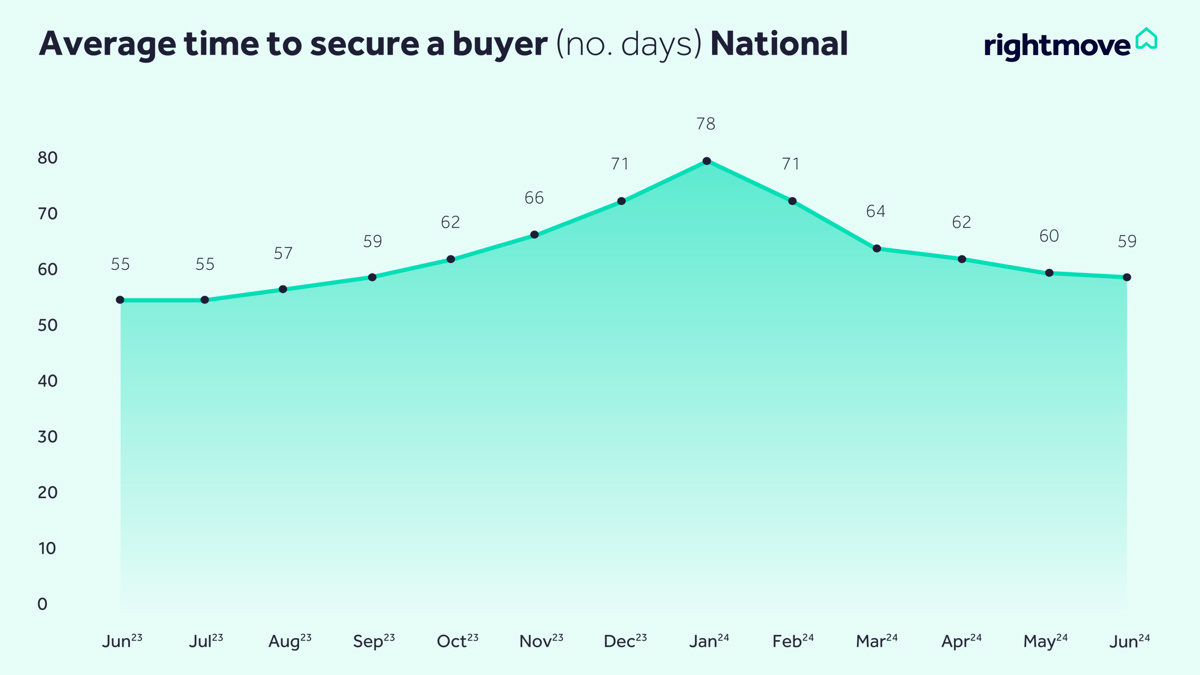

Transactions

The number of sales being agreed is now an encouraging 15% above the same period a year ago when we were approaching the peak of mortgage rates. This compares to last month’s figure which was +6% above last year. This positive sales figure emphasises that serious home hunters have been largely undeterred by the General Election and have been getting on with their moves. Similarly, the number of new sellers coming to market in the last four weeks is a steady 3% above last year, indicating that despite the uncertainty of an election, most movers haven’t been put off. (Rightmove)

Transaction levels are increasing with the latest HMRC figures showing a 17% rise in May compared to a year earlier.

Investment/lettings

Average UK private rents increased by 8.7% in the 12 months to May (ONS, Price Index of Private Rents).

The average UK rent rose by 0.2% in June to £1,299, 5.7% higher than the same time last year (HomeLet). The average void period was 17 days in June, significantly down from 21 days in May (Goodlord).

We hope that was useful and informative. As always, our teams are here to help, get in touch with any questions about your local property market, and to discuss your home move considerations.

If securing a new mortgage or arranging a re-mortgage is important for you right now, click here to book an online consultation, our mortgage brokers are independent, and their services are free to you.

Finally, if you are (understandably) confused by some of the mixed market reporting, not least by some of the more sensational news reporting each month, click here for some independent insight into how House Price Indexes are compiled.

Sources: Rightmove, Zoopla, On the Market, Dataloft, Land Registry, National House Price Index, DLUHC

Contact your nearest office if you have any questions about your local property market.

Share

Tags