October Market Report. Local property news for you...

In a market reflective of some uncertainty and the current pressures on households, our offices across Bristol remain busy, all be it with very pragmatic, price-sensitive sellers and buyers.

As usual, let's take a look at the data and comments from trusted reporting.

“New seller asking prices have seen a rise, as they usually do at this time of year following the summer holiday season. While this year’s much more subdued rise indicates that some new sellers are gradually heeding their agents’ advice to price competitively, agents report that other sellers still need to adjust their expectations on the price that they are likely to achieve in the current post-pandemic, lower-activity market, where six in ten homes are now selling rather than eight in ten. In a market that agents describe as the most price-sensitive ever, buyers are likely to be on the look-out for homes that they feel represent excellent value, and to attract one of these motivated buyers, sellers need to price right first time. If similar nearby properties for sale appear overpriced, serious sellers have an opportunity to stand out from the crowd with a more competitive price and attract immediate buyer interest that our research shows significantly increases the likelihood of finding a buyer.” Tim Bannister Rightmove’s Director of Property Science

Economy

The Bank of England has held base rates at 5.25%, ending a cycle of 14 consecutive rate rises. Consumer confidence rose to –21 in September 2023 from –25 in August, its highest reading since January 2022 (GfK Consumer Confidence Tracker). Inflation fell to 6.7% in the year to August, down from 6.8% in July, the third month in a row that the figure has dropped. Slowing food prices helped drive the fall (ONS).

Prices

The average price for a property in July was £289,824, up 0.6% year-on-year, and 0.5% on the previous month (ONS).

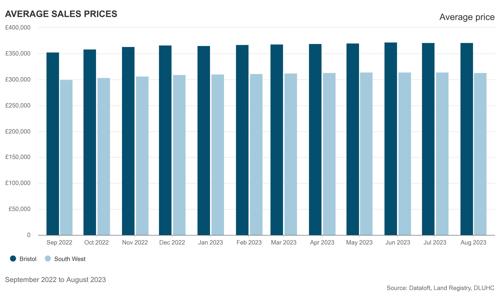

Bristol overview; over the last 12 months the average sales price in Bristol was £370,653. 32% of sales in the past 12 months were flats, achieving an average sales price of £277,998. Houses achieved an average price of £425,359. The highest value recorded by the Land Registry over the past 12 months was £2,950,000 for a flat and £3,500,000 for a house.

Transactions

The HMRC reports that 87,010 sales took place in August. This is a small improvement of 1.1% on the previous month, but significantly lower than last year's higher levels (-15.6%). RICS' measure for Agreed Sales in the latest survey came in at a net balance of -37% in September, an improvement on August and July, but still negative. The number of first-time buyers fell 22% between January and August this year, compared to the same period last year (Halifax).

Demand

Zoopla says - "Our House Price Index for September 2023 shows a rise in buyer demand after the summer lull, with enquiries to estate agents up 12% since the August Bank Holiday weekend. This measure of buyer demand is now in line with 2019.

The uptick in enquiries is partly seasonal, as we usually see people return to their home-moving goals when the summer holidays end. But it also reflects that consumer confidence is at a two-year high, boosted by the prospect of lower mortgage rates on the horizon. Buyer demand has improved in all parts of the country, most noticeably in the South of England which has had the fewest enquiries throughout 2023.

Our latest House Price Index has also recorded more agreed sales this month, matching the levels of 2019. This is supported by a boost in the number of homes for sale to pre-pandemic levels, giving much greater choice for people buying a home".

Investment/lettings

At 5.5% in August, annual growth in rental prices in the UK is at its strongest since records began. The Index of Private Rented Housing Prices reports on both new lets and renewals. The average rent on newly agreed rental contracts reached £1,276 in September, a 10.1% year-on-year increase (Homelet). Letting agents have an average of 25 email and phone enquiries for every property on their books, triple more than 2019 levels and five times more than May this year.

Outlook

According to Zoopla, the housing market continues to adjust to higher borrowing costs. Mortgage rates have more than doubled since 2021 which, together with increased costs of living, represents a big adjustment for home buyers and the wider housing market. The impact on house prices has been small compared to how much buyer power has been hit. Forbearance by lenders, tough mortgage regulations and the strong labour market have moderated the stress. Previous cycles of similar economic conditions saw much larger house price falls. The biggest impact so far has been on the number of sales in the market. These are on track to reach 1 million in 2023, which will be a fifth lower than in 2022. This number is tracking above 2019 levels, despite lower buyer demand. It’s evidence that there are still buyers who are serious about moving, though they’re fewer in number. Some buyers are returning to the housing market this autumn having delayed their move while the Bank Rate moved higher. Many others continue to wait on the outlook for mortgage rates as they maintain their requirements in their next property.

“Mortgage rates continue to trend in the right direction and have now dropped for 11 consecutive weeks, with buyer affordability gradually improving compared to this time a year ago. Those with a larger deposit have seen the biggest benefit from recent rate drops, with rates for those with a smaller deposit, typically those further down the housing ladder, not dropping as quickly. The mortgage market is much more stable right now compared to three months ago, giving movers a little more assurance over the rate they are likely to be offered and therefore what they are likely to be able to afford. Those looking to secure a new home for the new year should apply for a Mortgage in Principle to work out what they could afford, and listen to local estate agents about what’s happening in their local housing market.” Tim Bannister Rightmove’s Director of Property Science

Finally, if you are (understandably) confused by some of the mixed market reporting, not least by some of the more sensational news reporting each month, click here for some independent insight into how House Price Indexes are compiled.

Sources: Rightmove, Zoopla, On the Market, Dataloft, Land Registry, National House Price Index, DLUHC

Contact your nearest office if you have any questions about your local property market.

Share

Tags